The Sultanate of Oman has consistently emerged as an attractive destination for Foreign Direct Investment (FDI), marked by significant growth and well-defined long-term strategic plans.

Foreign investment inflows into Oman have risen sharply, reaching OMR 26.677 billion by the end of Q3 2024 representing a 16.2% growth rate compared to the same period in 2023.

Recent data indicates that total FDI is expected to rise to OMR 30.1 billion by the end of 2024. This robust growth is primarily driven by Oman Vision 2040, a comprehensive roadmap aimed at economic diversification and the development of a competitive, knowledge-based economy.

While the oil and gas extraction sector still accounts for the majority of historical FDI stock (79.1% as of Q3 2024), the government’s focus and the direction of new investment flows has increasingly shifted toward non-oil sectors such as manufacturing, logistics, renewable energy, and tourism.

The manufacturing sector alone experienced an 8.6% growth rate in 2024, attracting OMR 2.48 billion in foreign investment.

Oman’s legal framework has also been significantly liberalized with the enactment of the new Foreign Capital Investment Law (Royal Decree No. 50/2019), which allows 100% foreign ownership in most sectors and eliminates minimum capital requirements.

The country also offers a range of competitive incentives, including tax exemptions (for up to 30 years in free zones), customs exemptions, and full repatriation of capital and profits.

Digital platforms such as Invest in Oman have streamlined business registration and licensing processes, enhancing transparency and efficiency.

Introduction to Foreign Direct Investment in Oman

This section explores the strategic context of foreign investment in Oman, highlighting the country’s inherent advantages and the core policy frameworks driving its economic transformation. It emphasizes Oman’s unique geopolitical position and its commitment to establishing a stable and predictable investment environment.

Oman’s Strategic Appeal as an Investment Destination

Oman is increasingly recognized as an attractive destination for investment due to its combination of a distinctive geographic location and a stable political and economic environment. These factors work synergistically to reduce investment risk and build investor confidence.

Geographic Advantage

Located at the crossroads of Asia, Africa, and Europe, Oman offers unparalleled access to global trade routes and a consumer base of over one billion people across the Gulf Cooperation Council (GCC), Asia, and Africa. Its position outside the Strait of Hormuz enhances its appeal as a logistics and trade hub, and substantial investments have been made in world-class ports such as Salalah, Duqm, and Sohar, which serve as gateways to global markets.

These advanced port infrastructures, combined with Oman’s strategic location, have made the country a critical node in global supply chains.

Stable Political and Economic Environment

The Sultanate of Oman is characterized by political stability and a transparent legal system. It consistently scores high on regional transparency indices and has largely remained insulated from regional volatility. This stability provides a vital foundation for long-term investment, assuring investors that their operations will take place in a predictable environment.

Such stability enables the government to confidently implement long-term, ambitious policy frameworks like Oman Vision 2040. These policies are designed to capitalize on geographical advantages such as developing globally competitive ports to become a logistics center and to further enhance stability through systematic economic diversification and reduced dependency on volatile oil revenues.

This comprehensive and integrated approach is far more appealing to foreign investors than any single factor alone, reflecting a highly calibrated national strategy for long-term growth and resilience.

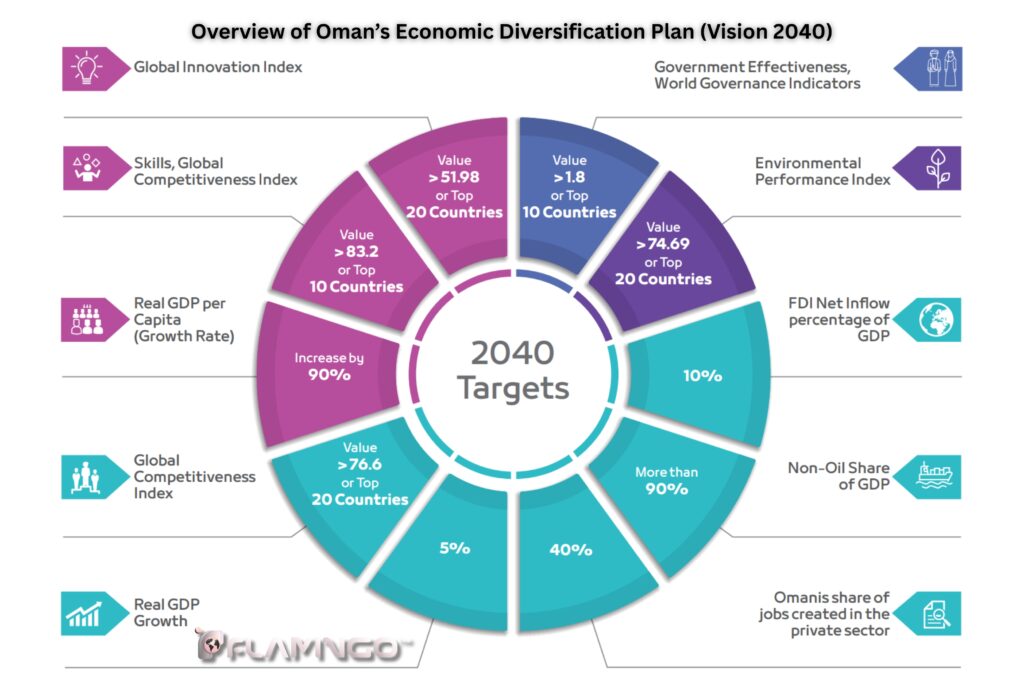

Overview of Oman’s Economic Diversification Plan (Vision 2040)

Oman Vision 2040 serves as a comprehensive roadmap for sustainable growth, aiming to diversify the economy beyond oil dependency and foster a knowledge-based and competitive economy. This vision has been developed through extensive consultations across all segments of society, reflecting broad national consensus on the country’s future path.

Core Pillars

The vision is built around key pillars such as economic prosperity (with attracting investment as a central goal), innovation leadership, and governance excellence. The plan strongly emphasizes reducing reliance on oil revenues and expanding non-oil sectors.

The government’s commitment to this vision is evident through royal directives aimed at enhancing the investment climate and launching initiatives to build a promising economic future.

Investment opportunities are proactively structured and backed by feasibility studies to accelerate foreign investment in targeted sectors, strengthen economic diversification, and increase the share of non-oil income in the Gross Domestic Product (GDP).

Current Outlook on Foreign Direct Investment (FDI) in Oman

This section presents a quantitative overview of recent FDI performance, highlighting notable growth trends and identifying key countries contributing to Oman’s foreign investment landscape. It also examines the current sectoral distribution of FDI, emphasizing the continued dominance of traditional sectors in total investment stock.

FDI Growth Trends and Recent Statistics

Oman has witnessed substantial growth in foreign direct investment, reflecting its success in attracting international capital. FDI reached OMR 26.677 billion by the end of Q3 2024, a 16.2% increase from OMR 22.961 billion in the same period in 2023.

Over the past five years, FDI has grown by 17.6%, reaching a cumulative value of OMR 26.7 billion by Q3 2024.

New data shows that total FDI is projected to reach OMR 30.1 billion by the end of 2024, up from OMR 22.9 billion in 2023. Recorded investment flows during this period amounted to OMR 3.715 billion.

Table 1: Oman FDI Trends (2023–2024)

Indicator | Q3 2023 (OMR billion) | Q3 2024 (OMR billion) | Growth Rate (YoY, %) | Investment Flows (2024, OMR billion) | Total FDI (End of 2024, OMR billion) |

Value | 22.961 | 26.677 | 16.2% | 3.715 | 30.1 |

These figures clearly reflect significant FDI growth and provide strong evidence of Oman’s success in attracting foreign capital. The comparative data allows readers to quickly grasp the upward FDI trajectory, reinforcing the narrative of Oman’s rising appeal as an investment destination. These numbers also serve as a foundational basis for understanding subsequent discussions on sectoral contributions, policy impacts, and future outlooks.

Leading Investor Countries and Their Contributions

The United Kingdom remains Oman’s largest foreign investor, accounting for 51.2% of total FDI and reaching OMR 13.664 billion by the end of Q3 2024.

The United States ranks second with OMR 5.252 billion.

Other major contributors as of Q3 2024 include the UAE (OMR 836.5 million), Kuwait (OMR 833.5 million), China (OMR 817.8 million), Switzerland (OMR 551.9 million), Qatar (OMR 488.3 million), Bahrain (OMR 375.7 million), Netherlands (OMR 359.1 million), and India (OMR 286.1 million).

Table 2: Top Investor Countries in Oman (Q3 2024)

Country | Total Investment (OMR billion) | Share of Total FDI (%) |

United Kingdom | 13.664 | 51.2% |

United States | 5.252 | 19.7% |

United Arab Emirates | 0.8365 | 3.1% |

Kuwait | 0.8335 | 3.1% |

China | 0.8178 | 3.1% |

Switzerland | 0.5519 | 2.1% |

Qatar | 0.4883 | 1.8% |

Bahrain | 0.3757 | 1.4% |

Netherlands | 0.3591 | 1.3% |

India | 0.2861 | 1.1% |

The UK’s dominance in Oman’s FDI likely reflects a deep historical relationship, particularly in oil and gas investments.

While having a strong primary investor is beneficial, such a high concentration (over 50%) introduces a degree of risk. Any significant economic downturn, policy shift, or change in the UK’s investment priorities could disproportionately affect Oman’s FDI outlook.

Oman’s active outreach efforts—participating in 21 global investment events, hosting delegations from 23 countries, and targeting six G20 nations demonstrate awareness of this concentration risk. This strategic push for investor diversification is crucial to ensuring long-term FDI resilience and reducing overreliance on a single market.

For potential investors from other regions, this signals an open and welcoming environment for new entrants.

Sectoral Distribution of FDI (Current Stock)

The oil and gas extraction sector continues to hold a significant share of Oman’s total FDI stock, accounting for 79.1% or OMR 21.112 billion by Q3 2024.

This high percentage reflects decades of accumulated investments forming the traditional backbone of Oman’s economy.

However, other sectors are gaining momentum:

• Manufacturing attracted OMR 2.136 billion (8%) by Q3 2024, showing an 8.6% growth in 2024 alone and drawing in OMR 2.48 billion in FDI.

• Financial intermediation accounted for OMR 1.36 billion.

• Real estate reached OMR 969.1 million, supported by a 5.5% increase in residential property prices in Q1 of the 2025–26 fiscal year.

Table 3: Key FDI-Attracting Sectors in Oman (Q3 2024)

Sector | FDI Value (OMR billion) | Share of Total FDI (%) | Growth/Key Flows |

Oil and Gas Extraction | 21.112 | 79.1% | – |

Manufacturing | 2.136 | 8.0% | 8.6% growth in 2024; OMR 2.48 billion attracted |

Financial Intermediation | 1.36 | 5.1% | – |

Real Estate | 0.9691 | 3.6% | 5.5% increase in residential property prices |

This table offers a clear quantitative snapshot of the sectors currently attracting the most FDI, especially those prioritized under Vision 2040.

For investors seeking high-potential areas aligned with national development goals, this information is highly valuable.

By presenting FDI data by sector, it implicitly highlights where government support and institutional backing (e.g., from the Oman Investment Authority) are concentrated, pointing to the most policy-favored environments and future opportunities for public-private partnerships.

Key Sectors Attracting Foreign Investment in Oman

This section provides a detailed analysis of the sectors currently receiving substantial foreign investment or those strategically prioritized for future growth under Oman Vision 2040. It outlines specific opportunities within each sector and explains how government policies and initiatives actively support their development.

In-Depth Analysis of Investment Opportunities

Oman is implementing a comprehensive strategy to diversify its economy beyond the traditional oil and gas sector, focusing on high-growth industries. This approach includes identifying and developing strategic “verticals” or interconnected industrial clusters. For instance:

• Strong logistics infrastructure (ports, free zones) supports manufacturing and trade.

• The shift toward green hydrogen and solar energy forms an integrated energy vertical.

• Digitalization and ICT are viewed as foundational elements that can enhance efficiency and innovation across all targeted sectors.|

This vertical or cluster-based development model promotes a more synergistic and integrated economic transformation. By strengthening linkages between related industries, Oman aims to build flexible value chains, attract complementary investments, and ultimately create a more competitive and diversified economy.

For foreign investors, this means opportunities are often amplified when their investments align with or support these broader strategic verticals, leveraging existing infrastructure and cross-sectoral momentum.

Oil & Gas (Traditional but Evolving Role)

This sector still holds the largest share of Oman’s total FDI stock OMR 21.112 billion, or 79.1% as of Q3 2024.

The Oman Investment Authority (OIA) continues to commit significant capital to energy projects, with 68% of its National Development Fund commitments in 2024 directed to this sector, including additional financing for the Duqm refinery.

Despite its dominance, the sector faces challenges such as global price volatility, environmental pressures, and high upfront capital needs for advanced technologies.

Manufacturing & Industry (The Cornerstone of Diversification)

Manufacturing has been identified as a national priority under the 10th Five-Year Development Plan (2021–2025).

By Q3 2024, the sector had attracted OMR 2.136 billion in FDI and experienced 8.6% growth in 2024, securing OMR 2.48 billion (USD 6.45 billion) in foreign investment.

Its GDP contribution grew from OMR 2.4 billion in 2020 to OMR 4.1 billion in 2024, with a bold target of OMR 11.6 billion (USD 30 billion) by 2040.

Focus areas include food processing, chemicals, medical devices, and advanced manufacturing.

Free zones offer 100% foreign ownership and tax exemptions for up to 30 years.

This strong performance and clear prioritization make manufacturing a tangible indicator of Oman’s successful diversification strategy.

Unlike raw material extraction, manufacturing adds value and creates more diverse jobs and a more stable economic base.

For forward-thinking investors, this signals a high-priority sector with robust government support, a clear growth path, and long-term return potential.

Transport & Logistics (Leveraging Strategic Location)

This sector is a key focus of Oman Vision 2040.

It benefits from Oman’s world-class ports Salalah, Duqm, and Sohar and free zones with advanced infrastructure and tax incentives.

The National Logistics Strategy 2040 aims to integrate ports, airports, free zones, and economic zones into a seamless network.

The OIA has invested in projects like the Asyad container terminal.

Renewable Energy (Focus on Green Hydrogen, Solar, and Wind)

Renewables are a strategic priority under Vision 2040.

Oman is investing heavily in green hydrogen and aspires to become a global leader in this field.

Solar and wind projects have gained traction with government support.

The OIA has launched 500 MW solar power plants and aims to expand renewable energy further.

This sector requires high upfront investment and careful planning for grid integration.

Tourism & Hospitality (A Thriving Industry)

Tourism is recognized for its stunning landscapes and cultural experiences.

The government is investing in luxury resorts, eco-tourism, and cultural initiatives, creating opportunities for foreign investors in hospitality, travel agencies, and adventure tourism.

New investment opportunities are regularly promoted via platforms like Invest in Oman.

Information Technology & Digitalization

IT is a key sector under Vision 2040, with the goal of creating a knowledge-based and tech-driven economy.

Oman is nurturing a tech ecosystem through national programs in AI and advanced technologies.

The Future Generations Fund and Oman Future Fund, managed by the OIA, invest in AI, fintech, ICT, and agritech.

Digitalization is a core pillar of economic transformation, aiming to increase its GDP share from 2% to 10%.

Fisheries & Aquaculture

Oman’s 3,165 km coastline offers immense potential.

With support from the World Bank, the government envisions a profitable, sustainable, and tech-driven fisheries sector.

New investment opportunities are being launched via platforms like Tatweer.

Mining

Mining is a priority sector in Vision 2040.

Oman holds untapped mineral reserves, including copper, gold, limestone, and gypsum, and is actively encouraging foreign investment.

The OIA has reactivated copper mining projects.

Financial Intermediation & Real Estate

By Q3 2024, financial intermediation attracted OMR 1.36 billion in investment.

The real estate market is showing positive momentum with a 5.5% increase in residential property prices in Q1 of fiscal year 2025–26.

Foreign investors can now purchase freehold property in designated areas.

Oman’s Legal and Regulatory Framework for Foreign Direct Investment (FDI)

This section provides an in-depth analysis of the legal and regulatory landscape governing FDI in Oman. It details transformative changes introduced by the Foreign Capital Investment Law (FCIL) of 2019 especially in relation to foreign ownership and capital requirements. Additionally, it covers the Commercial Companies Law, the evolving list of restricted activities, and key legal guidelines for foreign-local partnerships, with an emphasis on penalties for non-compliance.

In-Depth Review of the Foreign Capital Investment Law (Royal Decree No. 50/2019)

The Foreign Capital Investment Law (FCIL), enacted through Royal Decree 50/2019 and effective from January 7, 2020, significantly liberalized foreign direct investment in Oman.

Liberalization of Ownership

The law allows 100% foreign ownership in most sectors, a major shift from the previous law, which generally capped foreign ownership at 70%.

Elimination of Minimum

Capital Requirements

The FCIL abolished the previous minimum share capital requirement of OMR 150,000 (approx. USD 390,000), enabling investment at varying scales.

There are now no specific capital thresholds, provided that the investor adheres to a feasibility study and execution timeline.

Investor Protection

FCIL was designed to provide a more open, welcoming, and robust regulatory environment, offering strong investor protections and significantly reducing business registration time.

Licensing Requirement

Article 3 of the FCIL explicitly prohibits foreign nationals from engaging in investment activity in Oman without obtaining a license from the Ministry of Commerce, Industry and Investment Promotion (MCIIP).

Commercial Companies Law (Royal Decree No. 18/2019)

This law governs the formation and registration of companies, mandating that all partnership agreements must be filed in the Commercial Registry under the MCIIP.

• Article 5 states that companies failing to adopt a recognized legal form will be deemed null and void.

• Article 14 affirms that legal personality is only granted after official registration.

Commercial Companies Law (Royal Decree No. 18/2019)

This law governs the formation and registration of companies, mandating that all partnership agreements must be filed in the Commercial Registry under the MCIIP.

• Article 5 states that companies failing to adopt a recognized legal form will be deemed null and void.

• Article 14 affirms that legal personality is only granted after official registration.

Analysis of Restricted Activities for Foreign Ownership (Ministerial Decisions)

While 100% foreign ownership is generally allowed under FCIL, there are exceptions listed in the “Recently Published List of Restricted Activities.”

• Initially, the list included 37 business activities.

• Ministerial Decision No. 435/2024, issued on August 29, 2024, added 28 more, bringing the total to 123 restricted activities.

These activities generally fall under traditional crafts, small-scale services, and local industries. Examples include translation services, tailoring, car repair, barbershops, taxi operations, and rehabilitation centers.

Table 4: Examples of Activities Restricted from 100% Foreign Ownership

Category | Specific Activities (Examples) |

Handicrafts Production | Flower and plant distillation, frankincense oil production, leatherwork, woodcrafts, incense production, pottery, silver handicrafts |

Retail & Rentals | Specialty shops for construction scrap, event furniture rental, bottled water retail |

Agricultural/Environmental | Freshwater fish farming, ornamental plant cultivation, used battery and oil collection |

Service Industries | Skincare services, mobile cafés, notary services, LPG fuel station operations, salons and barbershops |

Vehicles & Miscellaneous | Used vehicle sales, grocery stores, document service centers, auto repair |

This table offers clear, actionable guidance for foreign investors and illustrates the dual nature of Oman’s FDI policy liberalized yet selectively protective of local sectors.

It helps potential investors quickly determine whether their intended business activity falls under these restrictions, enabling them to avoid costly missteps, ensure compliance, or consider alternative joint venture structures from the outset.

Legal Guidelines for Foreign-Local Partnerships and Penalties for Non-Compliance

Partnerships between foreign investors and local firms play a vital role in advancing Oman’s economic growth by facilitating the exchange of expertise and technical knowledge, particularly in sectors such as construction, energy, and mining.

However, these partnerships must adhere to specific legal guidelines to structure relationships properly and protect the rights of all stakeholders.

⚠️ Non-compliance with licensing or registration requirements may lead to invalidation of contracts, loss of legal protections, or regulatory penalties under Omani law.

This legal framework ensures transparency, safeguards both local and international interests, and reinforces Oman’s credibility as an FDI destination aligned with global standards.

The Importance of Formalization in Oman’s FDI Framework

The Foreign Capital Investment Law (Royal Decree No. 50/2019) and the Commercial Companies Law (Royal Decree No. 18/2019) emphasize the mandatory registration of all partnership agreements in the commercial registry and the acquisition of relevant licenses from the Ministry of Commerce, Industry and Investment Promotion (MCIIP).

Article 3 of the FCIL explicitly prohibits foreign nationals from engaging in any investment activity in Oman without first obtaining a license.

Consequences of Non-Compliance

Failure to formally register such partnerships can carry serious legal and financial risks for both foreign investors and local partners:

1. Nullification of Agreements

Unregistered partnership agreements are deemed “entirely null and void”, meaning they hold no legal weight. In case of disputes, courts will not recognize or enforce claims based on such agreements, leaving both parties unprotected.

2. Financial Penalties

Under Article 33 of the FCIL, foreign investors engaging in unlicensed activities may face fines ranging from OMR 20,000 to OMR 150,000.

Local partners involved in these unregistered activities are also subject to the same penalties, highlighting the shared risk of informal arrangements.

3. Liability Toward Third Parties (De Facto Partnership)

If an unregistered partnership is disclosed to third parties, it may be classified under Article 85 of the Commercial Companies Law as a “de facto partnership.”

These arrangements, though lacking formal legal recognition, can impose joint and several liability on the partners for obligations to third parties creating unexpected financial and legal exposure for foreign investors.

Supreme Court Precedent

A landmark Supreme Court ruling (Case No. 34/2004) illustrates the practical implications of non-compliance.

In this case, a foreign investor sued a local partner over profits from an undocumented and unregistered partnership.

The court declared the agreement invalid due to failure to meet FCIL requirements (registration and licensing).

However, based on submitted evidence, the court acknowledged the existence of a “de facto partnership”, settling financial rights and obligations only for the period before the judgment, while rejecting any future claims or obligations.

Key Takeaways

This case, and the broader legal framework, underline that informal or undocumented partnerships, while seemingly convenient, carry major legal and financial risks for both foreign and local stakeholders.

• The “de facto partnership” concept may allow retrospective recognition of past transactions but denies any future enforceability, highlighting the instability of such arrangements.

• Foreign investors, especially those accustomed to more lenient regulatory environments or considering informal collaborations, must prioritize legal precision and formal registration from the outset.

• Oman’s legal system is clear and firm on these requirements, and non-compliance can result in significant financial loss, lengthy legal disputes, and forfeiture of legal recourse.

✅ The absolute necessity of engaging qualified local legal professionals from the beginning cannot be overstated. Doing so is essential to navigate Oman’s regulatory landscape effectively and ensure full compliance.

Government Strategies and Investment Incentives in Oman

This section provides a comprehensive overview of Oman’s active strategies and attractive incentives for facilitating and attracting foreign direct investment (FDI). It highlights the central role of Vision 2040, the integration of digital platforms, the development of special economic zones, and a wide array of financial and non-financial benefits designed to create a highly appealing investment climate.

Oman Vision 2040: Strategic Pillars and Economic Diversification Goals

Oman Vision 2040 is the primary guiding framework aimed at diversifying the economy beyond oil by focusing on high-growth sectors such as tourism, fisheries, and technology.

Key pillars include economic prosperity with investment attraction as a central goal and innovation leadership.

Strategic programs such as the Economic Diversification Plan aim to increase the non-oil GDP share and stimulate private sector growth.

The Digital Transformation Program focuses on increasing digitalization in both public services and economic sectors.

Positive FDI trends are attributed by the Ministry of Commerce, Industry and Investment Promotion (MCIIP) to royal directives that support an improved investment environment.

The government also actively structures investment opportunities with feasibility studies to support investor decision-making.

“Invest in Oman” Platform and Digital Facilitation Initiatives

The “Invest in Oman” portal serves as a unified digital platform simplifying business registration, site selection, licensing, and government approvals.

It offers customized advisory services, supports both English and Arabic, and has issued over 1.2 million electronic documents and more than one million automated licenses since launch demonstrating Oman’s commitment to e-governance and transparency.

The platform currently lists 20 investment projects across sectors, while the “Tatweer” platform has announced 151 new investment opportunities in agricultural and industrial ventures.

This dual investment in world-class physical infrastructure (ports, free zones) and digital governance platforms reflects a strategic, integrated approach.

Physical infrastructure provides real-world capacity and a competitive edge for logistics and industrial operations, while digital platforms reduce bureaucracy and increase ease of doing business.

🧠 Together, they create a highly efficient and investor-friendly ecosystem, addressing both “hard infrastructure” (assets, connectivity) and “soft infrastructure” (regulatory ease, digital public services), positioning Oman as a modern, forward-thinking investment destination.

Role of Free Zones and Special Economic Areas (e.g., Duqm, Salalah, Sohar)

Oman’s free zones particularly the Special Economic Zone at Duqm (SEZAD) are magnets for investment in logistics, manufacturing, warehousing, and transportation.

SEZAD alone has attracted over OMR 6 billion in committed investment across hydrogen, petrochemicals, logistics, and tourism.

The World Bank has financed USD 1.2 billion in infrastructure at SEZAD.

Key incentives in these zones include:

• Corporate income tax exemptions for up to 30 years

• Customs exemptions

• Reduced Omanization quotas (under 20%)

These zones are more than just geographic areas with standard perks—they act as policy laboratories where liberal frameworks (e.g., longer tax holidays, lower localization requirements) can be tested before wider national rollout.

They represent the most streamlined, incentive-rich, and operationally efficient environments for foreign investors to launch and expand operations.

Comprehensive Overview of Financial and Non-Financial Incentives

Tax Incentives

• No Personal Income Tax

Oman imposes no personal income tax, enhancing the financial appeal of living and working in the country.

• Corporate Tax Exemptions

Sectors such as manufacturing, mining, agriculture, fisheries, aquaculture, livestock, tourism, export-oriented production, and public utilities benefit from corporate tax holidays of up to 5 years, with extensions available under certain conditions.

• Free Zone Tax Exemptions

Companies in free zones enjoy 30-year corporate income tax exemptions, making them attractive for long-term investment.

Customs Exemptions

• Select industries benefit from customs exemptions on imported equipment and materials.

• Goods originating from GCC and other Arab countries under trade agreements are also duty-free.

Capital Freedom

• Oman permits unrestricted capital inflows and outflows, with no limitations on profit repatriation, ensuring operational flexibility.

Long-Term Residency Permits

• Foreign investors can obtain 5- or 10-year renewable residency visas for themselves and their families, depending on the investment amount.

Competitive Operating Costs

• Oman offers low land rental rates in selected zones and competitive utility prices (electricity, water) compared to regional neighbors reducing overall business operating costs.

Access to Finance

• Investment funding is available through:

o Commercial bank loans (e.g., Bank Muscat)

o Government grants and subsidies

o Venture capital for tech startups

International Promotion & Market Access

• Oman actively markets itself globally:

o Hosting delegations from 23 countries

o Organizing 8 domestic promotional events

o Participating in international investment forums

Free Trade Agreements (FTAs)

• Existing FTAs with Singapore, Switzerland, and Pakistan open new routes for trade and international business expansion.

This comprehensive mix of incentives spanning digital enablement, legal reform, infrastructure development, and policy liberalization—positions Oman as one of the most progressive and investor-centric economies in the region, aligned with Vision 2040’s goals of resilience, innovation, and sustainable growth.

The Economic Impact of Foreign Direct Investment (FDI) in Oman

This section explores the multifaceted impacts of FDI on Oman’s economy, including its role in economic diversification, GDP growth, employment generation, human capital development, and technology transfer.

Contribution to Economic Diversification and GDP Growth

FDI plays a vital role in supporting Oman’s economic diversification strategy and reducing the nation’s reliance on oil revenues—fully aligned with the long-term goals of Oman Vision 2040.

Oman’s economic growth is increasingly driven by non-oil sectors.

For example:

• The manufacturing sector grew by 8.6% in 2024

• The industrial sector expanded by 2.8%

• The services sector grew by 4.2%

The manufacturing sector’s contribution to GDP increased from OMR 2.4 billion in 2020 to OMR 4.1 billion in 2024, marking significant progress toward diversification targets.

Impact on Employment and Human Capital Development

FDI contributes to job creation and complements domestic investment in Oman.

With around 550,000 Omanis expected to enter the workforce by 2032, the country needs to generate over 220,000 jobs for its citizens in the next eight years.

Currently, the private sector heavily depends on foreign workers, who account for 86% of private sector employment.

This reliance on low-cost, low-skilled foreign labor has allowed the non-hydrocarbon sector to expand and maintain high margins.

To address this imbalance, Oman, like other GCC countries, employs administrative tools such as Omanization quotas to enforce the employment of nationals in the private sector.

These quotas are more flexible in SMEs and less desirable occupations but stricter for administrative and managerial roles.

They are supported by wage subsidies, which help reduce the cost gap between Omani and foreign workers.

The government is also addressing these challenges through major investments in education and vocational training to ensure a steady supply of skilled national labor.

Innovation parks and incubators, along with public-private partnerships, have been launched to support startups and talent development.

Additionally, labor market reforms in 2023–2024 aim to increase flexibility and encourage the hiring of Omanis in the private sector.

While FDI generally contributes to job creation and technology transfer, Oman faces a dual challenge:

1. Converting these benefits into high-skill national employment

2. Effectively absorbing advanced technologies to enhance export competitiveness

The high reliance on low-skilled expatriate labor calls for human capital development and targeted technology policies.

Role in Technology Transfer and Innovation

FDI introduces new organizational and managerial practices, as well as access to technology and know-how.

Digitalization is a core pillar of Vision 2040, with a goal of increasing the digital economy’s contribution to GDP from 2% to 10%.

However, Oman still requires greater investment and effort in:

• Improving internet speed

• Increasing ICT skill prevalence among the population

• Promoting digital innovation

• Expanding e-commerce

Increased digitalization is key to enhancing government efficiency, transparency, and access to public services.

Innovation parks and incubators are nurturing a growing tech ecosystem.

The Oman Investment Authority (OIA) actively invests in AI and FinTech.

However, some studies indicate a negative correlation between FDI and high-tech exports/imports, suggesting difficulties in effectively disseminating or absorbing technology.

Thus, digitalization is not just about growing the ICT sector it is a foundational element for:

• Improving government performance

• Enhancing business productivity

• Boosting overall economic competitiveness

This is essential for attracting advanced FDI and maximizing its economic benefits.

Challenges and Risks for Foreign Investors in Oman

While Oman offers an attractive investment environment, foreign investors must be aware of certain challenges and risks that may arise in the local market.

Capital Market Constraints and Liquidity Issues

Oman’s capital markets remain relatively small and illiquid compared to other GCC countries.

• The domestic bond market is limited in size and heavily concentrated in primary market activity.

• The secondary market for government securities is nearly inactive due to low liquidity and the absence of a market-maker system.

• Non-resident participation is low, hindered by lack of liquidity and regulatory barriers such as no over-the-counter (OTC) trading and no connection to Euroclear.

This means investors may need to rely more on direct investment rather than public market access.

Competition and Market Saturation in Specific Sectors

Some of Oman’s key sectors face competitive pressures:

• Tourism: The sector is affected by seasonal fluctuations (peak in winter, low demand in summer) and intense competition from regional destinations like the UAE and Qatar.

• Real Estate: While demand is growing, certain areas particularly the residential segment may be experiencing oversupply. Careful location selection is critical.

• Manufacturing: Oman faces competitive pressure from neighbors such as UAE and Saudi Arabia, especially in industrial production.

Regulatory and Policy Risks

(such as changing regulatory frameworks and restricted activities)

The regulatory environment in Oman particularly in emerging sectors can be subject to change:

• Real Estate: The sector is sensitive to regulatory updates, especially concerning foreign ownership and property rights.

• Renewable Energy: As a relatively new sector, it carries risks related to policy shifts, changes in incentives, or regulatory updates.

• Restricted Activities: The growing list of restricted activities (now totaling 123) limits 100% foreign ownership in certain traditional and small-scale sectors.

This reflects a deliberate policy to protect specific local industries and align FDI with broader national development objectives.

Labor Market Dynamics (Omanization, Skilled Workforce Availability)

Access to skilled labor is a key concern.

• Some manufacturing industries may face challenges in recruiting skilled workers, especially for advanced production and technical roles.

• The private sector heavily relies on expatriate labor.

Government-imposed administrative measures, such as Omanization quotas, can be a business constraint.

These quotas are applied more strictly in administrative and managerial positions, while SMEs and low-preference jobs may face more flexibility.

Conclusion and Strategic Considerations

Although Oman is increasingly open to foreign investors with low taxes and free capital mobility its capital markets are still developing, posing challenges for liquidity and non-resident participation.

This suggests that direct investments may remain the preferred entry route over public market access.

Additionally, Oman’s diversification ambitions mean many new sectors are still in development. While promising, they come with inherent challenges like:

• Seasonality in tourism

• Market saturation in real estate

• Regional competition in manufacturing and renewable energy

To succeed, foreign investors must adopt tailored strategies that align with local dynamics and mitigate sector-specific risks.

Major Investment Projects and Future Outlook in Oman

Oman is actively executing large-scale investment projects aligned with its Vision 2040, aimed at enhancing economic diversification and attracting further foreign direct investment (FDI). These projects, coupled with a forward-looking approach, paint a positive outlook for future FDI inflows.

Key Projects Underway or Planned (Aligned with Vision 2040)

Oman is not only diversifying its economy but also strategically targeting emerging global economic trends, positioning itself for long-term competitiveness beyond traditional industries.

• Duqm Special Economic Zone (SEZAD):

This zone has attracted over OMR 6 billion in committed investments across hydrogen, petrochemicals, logistics, and tourism.

The World Bank Group has provided $1.2 billion in infrastructure financing.

• Green Hydrogen Projects:

Oman is making heavy investments in green hydrogen, aiming to become a global leader in this field.

The Oman Investment Authority (OIA) plans to expand its renewable energy portfolio.

• Sohar Polysilicon Plant:

Set to become the largest facility of its kind outside China, backed by investment from the OIA.

• Spaceport Projects (Etlaq and Duqm-1):

These represent Oman’s entry into the regional space race, leveraging its equatorial advantage.

The project aims to be fully operational by 2027, supporting satellite design, launch operations, and aerospace R&D in line with Vision 2040.

• Asyad Container Terminal:

A major logistics investment by the Oman Investment Authority.

• Mining:

The OIA has reactivated copper mines, contributing to the country’s critical minerals strategy.

• Digital Infrastructure:

Ongoing investments in digital infrastructure, R&D, and the nurturing of new industries.

The Future Generations Fund, managed by the OIA, is investing in AI, fintech, and emerging technologies. OIA has also invested in xAI.

• Tourism:

Government investments in luxury resorts and eco-tourism highlight a push toward experience-driven tourism.

• Fisheries and Aquaculture:

This sector is being transformed into a technology-driven and sustainably managed industry with support from the World Bank.

The role of sovereign wealth funds particularly the Oman Investment Authority (OIA) is critical in catalyzing strategic FDI.

These investments (e.g., Duqm refinery, solar power plants, Sohar polysilicon, xAI) de-risk major projects, attract co-investors, and demonstrate government commitment, making Vision 2040 priority sectors more attractive to private foreign capital.

Future Outlook for FDI in Oman

FDI in Oman is expected to grow steadily, fueled by Vision 2040 reforms and mega-project execution.

• Strategic focus areas include renewable energy, digital infrastructure, and critical minerals, while reducing dependence on hydrocarbons.

• Expansion of joint ventures is intended to accelerate knowledge transfer and technical capacity building.

Oman aims to become a competitive, knowledge-based economy and a regional leader in sustainable development.

Improved transparency and recognition by the World Bank have contributed to an upgrade of Oman’s investment-grade credit status, further enhancing its appeal to global investors.

Foreign Investment in Oman: A Strategic Gateway to Sustainable Growth

In recent years, Oman has witnessed a remarkable surge in foreign direct investment (FDI), driven by the nation’s long-term strategic framework, Oman Vision 2040. This roadmap aims to diversify the economy, promote sustainable development, and build a knowledge-based infrastructure creating an increasingly welcoming environment for international investors.

With its unique geopolitical location at the crossroads of Asia, Africa, and Europe, and a solid foundation of political and economic stability, Oman presents an ideal landscape for long-term investment. Government policy is no longer centered solely on the energy sector; emerging sectors such as manufacturing, ICT, renewable energy, tourism, fisheries, logistics, and mining are now actively supported and prioritized.

To enhance the investment climate, Oman has significantly reformed its legal framework, including the introduction of Royal Decree 50/2019, which permits 100% foreign ownership across most sectors and eliminates the requirement for minimum initial capital. These reforms are complemented by a suite of incentives including tax holidays, customs exemptions, unrestricted capital repatriation, and long-term residency options for foreign investors.

Digital platforms like “Invest in Oman” and world-class special economic zones such as Duqm have streamlined company registration and business setup. However, navigating this promising landscape still requires strict compliance with regulatory requirements, particularly around foreign-local partnerships and licensing procedures.

While challenges such as limited capital market liquidity or skilled labor shortages remain, the Omani government through proactive institutions like the Oman Investment Authority (OIA) is driving structural transformation across sectors.

Flamingo stands ready as your trusted partner on the ground. We offer comprehensive support for every stage of the investment process in Oman from market analysis and company formation to legal compliance and investor residency acquisition.